Translate this page into:

Impact of community-based health insurance and economic status on utilization of healthcare services: A household-level cross-sectional survey from rural central India

2 Department of Medicine, Mahatma Gandhi Institute of Medical Sciences, Wardha, Maharashtra, India

3 Global Health and Policy, Mahatma Gandhi Institute of Medical Sciences, Wardha, Maharashtra, India

Corresponding Author:

Rajnish Joshi

Department of Medicine and Community and Family Medicine, All India Institute of Medical Sciences, Saket Nagar, Bhopal 462024, Madhya Pradesh

India

rajnish.genmed@aiimsbhopal.edu.in

| How to cite this article: Joshi R, Pakhare A, Yelwatkar S, Bhan A, Kalantri S P, Jajoo UN. Impact of community-based health insurance and economic status on utilization of healthcare services: A household-level cross-sectional survey from rural central India. Natl Med J India 2020;33:74-82 |

Abstract

Background. Community-based health insurance (CBHI) is a health-financing mechanism based on voluntary membership, risk pooling, with a non-profit objective and relies on social capital as a driving force. It aims to improve equity in healthcare utilization in the community. We did this study to understand if CBHI schemes reach the poor, improve healthcare utilization and protect them from catastrophic health events.Methods. Mahatma Gandhi Institute of Medical Sciences (MGIMS), Sevagram, located in Wardha district of Maharashtra, India, runs a variety of CBHI schemes in surrounding villages. Many households (HHs) have opted for these schemes. We conducted a cross-sectional survey of all HHs of 35 villages and collected information about sociodemographics, inpatient healthcare utilization (in previous 5 years), outpatient healthcare utilization (in previous 1 year) and insurance status of the HHs. We derived wealth index based on 33 sociodemographic variables and classified HHs in quintiles of wealth index. We compared the distribution of healthcare utilization variables by insurance status and wealth index and used logistic regression to evaluate if health insurance independently improves healthcare utilization, after adjusting for confounders.

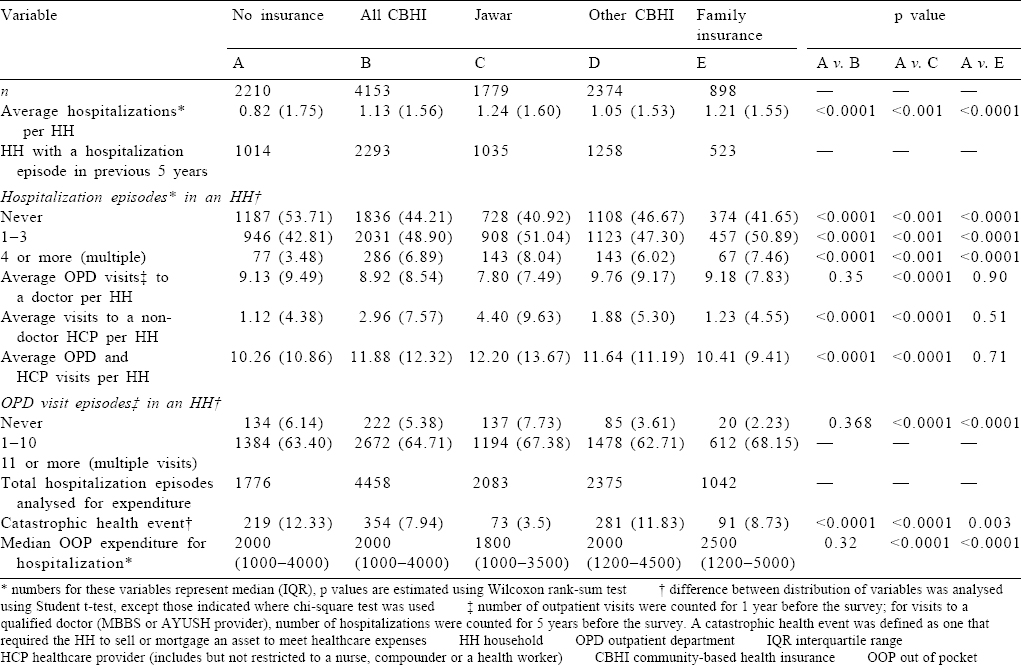

Results. Of a total of 7261 HHs surveyed, 2210 (30.4%) were uninsured, 4153 (57.2%) were insured under MGIMS CBHI schemes, and 898 (12.4%) had family insurance either from MGIMS or other providers. Insured HHs had a higher wealth index compared to uninsured. Mean (SD) hospitalization episodes in an HH were 0.82 (1.75) among uninsured, 1.13 (1.56) in CBHI insured and 1.21 (1.55) in those with family insurance. Within each category, healthcare utilization was lower for poor HHs (lowest quintile of wealth index) and higher for affluent HHs (higher quintiles of wealth index). Among those who were hospitalized, catastrophic health events were less in CBHI insured (7.9%) compared to uninsured (12.3%). After adjusting for socioeconomic status and other confounders, our data suggest that participating in a CBHI scheme increased odds of utilization of inpatient services (OR 1.18; 95% CI 1.04–1.33) and protected from catastrophic health events (OR 0.52; 95% CI 0.43–0.64).

Conclusion. CBHI schemes improve healthcare utilization and protect against catastrophic health expenditure among those who get hospitalized. However, there also exists a socioeconomic gradient both in membership and in utilization of healthcare services favouring those who are more affluent.

Introduction

India, a nation of 1.2 billion people, with health expenditure that is <5% of gross domestic product (of which 72% is out-of-pocket), strives to achieve universal health coverage (UHC) by the year 2020.[1] The goal of UHC is to ensure equitable access and utilization of healthcare, regardless of social, economic and geographic constraints, made available through the public sector.[2] To realize this goal, we must address barriers such as poverty, inadequate financing, the need to address social determinants of health, fragmented healthcare delivery system, unregulated and non-availability of adequately skilled human resources.[3] If the experience of other countries is predictive, the trajectory towards the goal of UHC is expected to be rough and long in India,[4] making it imperative that we carefully evaluate various healthcare financing and policy-level initiatives that have a potential to contribute to achieving UHC.[5]

Healthcare in India is heterogeneous, with a mix of free, not-for-profit and for-profit systems operated in the public and private sectors. Financial constraints are a major barrier for healthcare utilization especially for the poor and marginalized populations, and healthcare expenditure has been found to be a leading cause of indebtedness. Most healthcare is self-financed, private insurance is limited and unaffordable, and there have been limited experiments with community-based health insurance (CBHI) schemes.[6] Although health insurance is emerging as an alternative mechanism for the financing of healthcare, only 11% of the Indian population has any health insurance coverage, of which about 1% is covered by private health insurance.[6] CBHI is based on concepts of voluntary membership, non-profit objective, risk pooling and relies on social capital as a driving force.[7] CBHI is a form of micro-insurance gaining popularity in rural communities and links a healthcare provider in proximity to its beneficiaries. A scaled-up version of CBHI is state-supported insurance (such as Rashtriya Swasthya Bima Yojna [RSBY] in India) where political will is the driving force; risks are pooled and poor are cross-subsidised by the state.[1] RSBY is considered as one of the vehicles to achieve the goal of UHC in India,[8] although it needs to be evaluated if its benefits actually reach the poor.

CBHI schemes have been found to require close monitoring,[9] be contingent on motivating local leadership,[10] require strong social commitment[11] and trustworthy insurers.[12] A major criticism is that such schemes are not financially viable and fail to provide equitable coverage.[13] While the healthcare provider or the State can provide cross-subsidies to achieve financial viability, equity is a concern. Impact of CBHI schemes in achieving better health outcomes is debatable. While a higher treatment-seeking behaviour is seen among the insured,[14] this did not translate in reducing health-related economic inequality.[15] Studies have shown that CBHI insured have a better health-related quality of life,[16] and improved healthcare access.[17] On the contrary, some large government-sponsored schemes in rural India had little impact on healthcare utilization.[18],[19] Mahatma Gandhi Institute of Medical Sciences (MGIMS) Sevagram runs CBHI schemes that cater to populations in its vicinity.[6],[20],[21] These schemes have a unique model, where the provider is also insurer, and none of the pre-existing conditions or current diseases are excluded from the benefit package. We did this study to understand if such CBHI schemes have reached the poor, improved healthcare utilization and protected them from catastrophic health events.

Methods

Design

This was a household (HH) level questionnaire-based cross-sectional survey. The Institutional Ethics Committee of MGIMS, Sevagram approved the study.

Setting

MGIMS is a 648-bedded teaching hospital in Wardha district of Maharashtra state of India. It manages various not-for-profit CBHI schemes [Box 1].

Health subcentre (SC) is a unit of healthcare delivery in rural India (catchment population ~5000, about 4–5 villages), and 5–6 SCs constitute the catchment area for a primary health centre (PHC), a facility where a doctor is available. All services at these SCs and PHCs are free of cost. MGIMS hospital charges user fees for hospital services, which provide 25% of its finances and the remaining 75% of finances are from government grants. Healthcare costs at MGIMS are low, and in the year 2010, average inpatient hospital bill (which includes costs towards in-hospital stay, operative procedures, most investigations, selected medications and disposables) was about ₹1600. In 2010, health professionals at MGIMS cared for about 400 000 outpatients and 40 000 inpatients. About 60% of the inpatients are uninsured, 38% are insured in one of the schemes offered by MGIMS, and the remaining 2% receive free treatment under one of the national health programmes (unpublished data from the MGIMS hospital information system). No other state sponsored insurance scheme existed at that time.

Participants

We selected 7 health SC areas, 4 from Kharangana Gode PHC (Kharangana Gode, Karanji Bhoge, Madni and Yesamba), and 3 from Hamdapur PHC (Hamdapur, Jaipur and Kopra) of Wardha district. These SC areas were selected as HHs in most villages in their catchment are enrolled in CBHI schemes managed by MGIMS. We sought to include all HHs in all 35 villages in the areas of the SC. We identified community health workers (CHWs) from each village and trained them in the survey methodology. CHWs were supervised by trained medical social workers. We obtained community agreement through consultations. All HHs in each village were numbered. An HH was defined as members sharing a common kitchen. CHWs conducted a door-to-door HH-level survey, after obtaining a written informed consent from the head of the HH. Head of the HH was defined as a person considered as key decision-maker by members of the HH. We excluded those HHs where the head did not provide consent for participation. No other exclusion criteria were used.

Procedures

We designed a pilot-tested standardized questionnaire, administered in the local language for the survey. CHWs administered sociodemographic and insurance status components of the survey. Medical social workers administered the healthcare utilization component of the survey. We collected socio-demographic variables such as age, gender, education status, asset ownership, amenities and physical structures of the HH.

Since all insurance schemes operated by MGIMS are to be renewed annually, we enquired about the insurance status of each HH in the previous 5 years (2005–10). An HH was classified as a Jawar insured if for the majority of the years (3 or more of 5) the HH had this type of insurance. Similarly, HHs were classified as other-CBHI (for Bachat-Gat, Village or mixed CBHI insurance types), or Family insured. Those HHs which were never insured in this period were classified as non-insured.

We collected information about any hospitalization in the HH in the previous 5 years. A maximum of three proximal hospitalization episodes for every individual in an HH were analysed in detail, and additional questions were asked to determine the nature of illness, any economic burden felt during hospitalization, need to mortgage HH assets and total cost of hospitalization. A hospitalization event for which members of an HH either sold or mortgaged an asset was designated as a catastrophic health event. The cost of hospitalization included total out-of-pocket cost as reported by the family towards, medicines, investigations, hospital stay and transportation of the patient, as well as caregivers. We also collected information about outpatient visits to either a doctor, paramedic or a nonformal healthcare provider in the previous 1 year. A maximum of three proximal episodes per person were analysed in detail for cause, cost and any economic difficulties encountered in seeking outpatient care.

Statistical analysis

The study data were entered using EPI-Data. We constructed a wealth index as a secondary variable, by using a set of 33 primary variables, commonly used for this purpose.[22] These include ownership of livestock (availability in numbers for buffalo, cow, bulls, horses, donkey, sheep, goat and poultry), productive assets (tractor, motor pump and sewing machine), means of transport (bicycle, motorcycle and car), consumer durables (stove, refrigerator, washing machine, cooler/fan, television/video player, radio, telephone and video camera), HH amenities (lighting source and source of fuel), HH structure (type of dwelling, material for exterior wall, roof, floor and number of rooms in an HH), ownership of dwelling, agriculture land area owned by the HH, and level of education of head of the HH. We performed principal component analysis to convert these indicators into a single measure. The first principal component, which is the linear index of variables with the largest amount of information common to all of the variables components was used to assign weight to individual indicators. These weights were used to generate wealth score for each HH. We used quintiles of wealth-score to classify HHs as poor (lowest quintile), middle (second to fourth quintiles) and rich (highest quintile). We determined the distribution of healthcare utilization, and expenditure variables across insurance domains, and wealth index quintiles. We compared the distribution in the non-insured HHs or individuals as a reference with those who had CBHI (Jawar or other schemes), or family insurance. Categorical variables were tested using chi-square test, and continuous variables using Student t-test or Wilcoxon rank-sum test as appropriate. We used p<0.01 as a level of statistical significance.

Further, to determine if insurance status improves health utilization and protects against catastrophic health events independent of other confounders (age, gender, educational status, number of HH members, distance from hospital and wealth index) we estimated unadjusted and adjusted odds ratios (OR) and their 95% CI using multivariate logistic techniques. All statistical analyses were done using STATA-MP version 12.1 (College Station, TX, USA).

Results

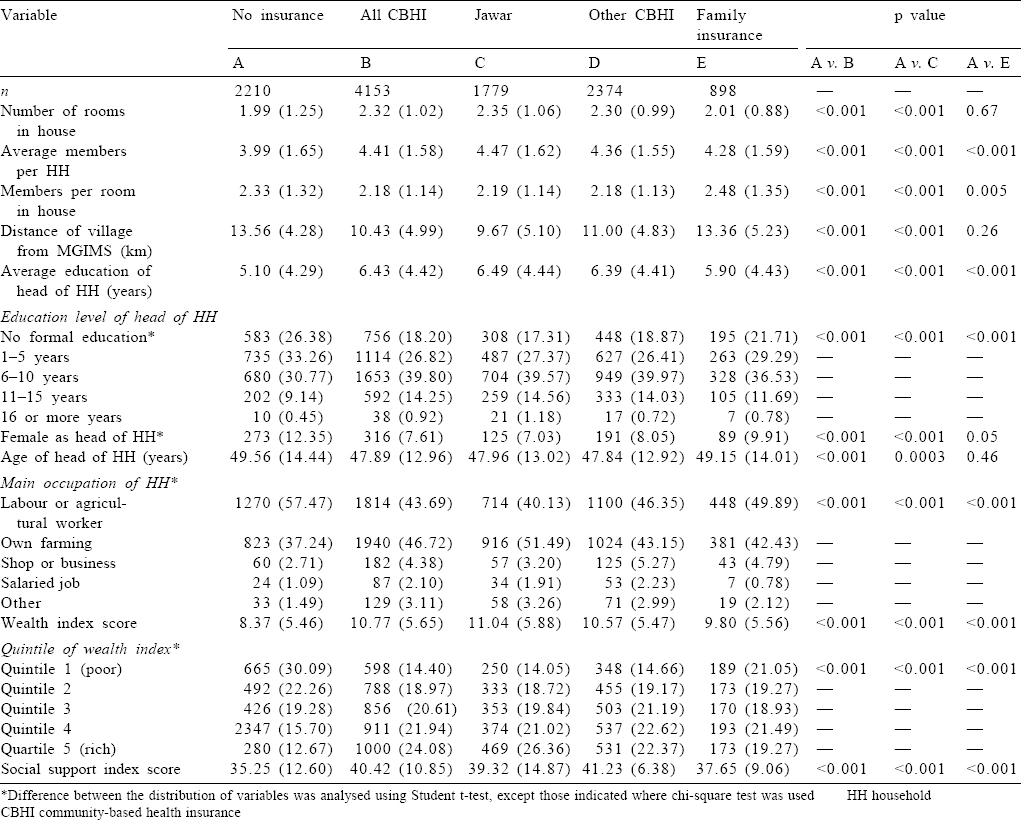

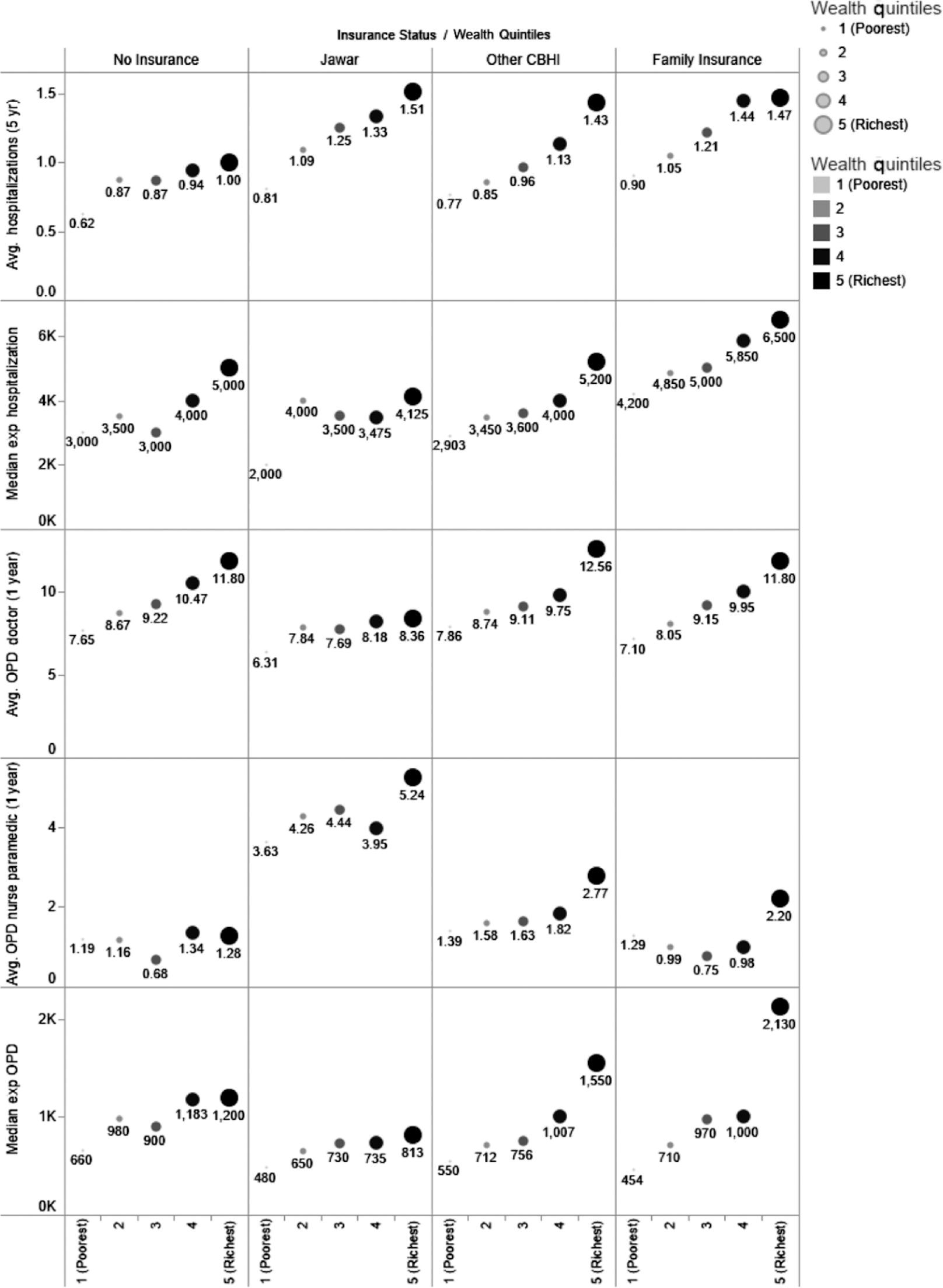

The study was conducted between August and November 2011, and a total of 7261 HHs (31 005 individuals) in 35 villages were surveyed. Of these 2210 (30.4%) HHs were uninsured, 4153 (57.2%) were insured under CBHI schemes (1779 [24.5%] insured under the Jawar scheme, and 2374 [32.7%] under other CBHI schemes), and 898 (12.37%) had family insurance either from MGIMS or other providers. Compared to CBHI HHs, uninsured HHs were significantly smaller in size, had fewer members and lived in a village farther away from MGIMS hospital. Head of these HHs had fewer years of education and was more likely to be a female in uninsured compared to CBHI HHs. The proportion of poor HHs was highest among uninsured (30%) compared to CBHI (14%) or family insurance (21%), which was statistically significant. The proportion of uninsured was 33.1% and 11%, respectively in poor (lowest quintile) versus rich (highest quintile of wealth index). Insured HHs perceived more social support, compared to uninsured [Table - 1].

Utilization of healthcare services for inpatient care (hospitalization) was significantly lower among uninsured HHs (mean [SD] hospitalization episodes in a HH within previous 5 years was 0.82 [1.75] among uninsured, v. 1.13 [1.56] among CBHI insured and 1.21 [1.55] among those with family insurance). Based on the data available from the hospital information system of MGIMS for the year 2007, 42% of all hospitalizations in CBHI insured were planned (including pregnancy, cataract surgeries and other elective procedures), 36% were acute unplanned conditions (including trauma, infections and poisonings), 5% remaining were due to acute complication of a chronic disease and 17% due to chronic disease management. These proportions were similar in the uninsured (44%, 32%, 6% and 18%, respectively).

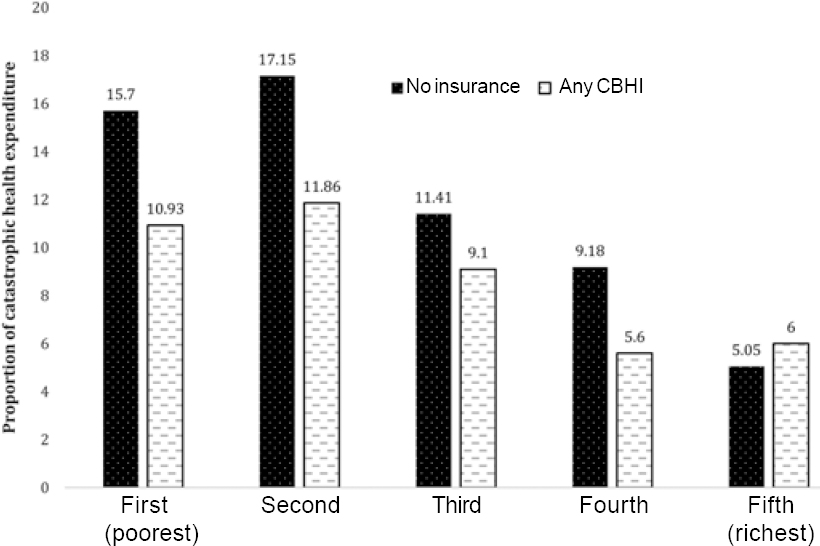

The proportion of HHs with multiple hospitalizations (defined as four or more over 5 years in a HH) was twice as much in insured (6.9% in CBHI insured and 7.5% in family insured) compared to uninsured (3.5%). In each insurance category, HHs in higher wealth index quintile had more mean hospitalization episodes. This effect was restricted to HHs in highest quintiles, as HHs in lower quintiles of wealth index mean hospitalization episodes were similar in insured, CBHI insured and family insured. HHs that were insured under a CBHI scheme also had more outpatient-based health-seeking visits (11.88 [12.32]) visits per HH per year in the CBHI scheme, compared to 10.26 [10.86] visits among uninsured). This was mostly contributed by visits to non-physician healthcare providers. However, this difference was not significant across wealth index quintiles [Figure - 1] and [Table - 2].

|

| Figure 1: Healthcare seeking and out-of-pocket expenditure by insurance and socioeconomic status |

Of 7261 HHs in this study, 3830 (58.7%) had one or more hospitalization episodes in the preceding 5 years. We analysed a total of 7276 hospitalization episodes, 1776 (24.4%) in uninsured, 4458 (61.2%) in CBHI and 1042 (14.3%) in family insurance HHs. Of all hospitalization episodes, 5108 (70.2%) were at MGIMS hospital, 1157 (15.9%) at government hospitals, 758 (10.4%) at for-profit private hospitals, and 253 (3.5%) at other not-forprofit private facilities. Overall economic difficulty in meeting hospital expenditure was reported for 697 (9.58%) episodes, and HHs had to sell or mortgage an asset (catastrophic health event) in 664 (9.13%) episodes. Catastrophic health events were significantly more in uninsured (12.3%) compared to those with CBHI (7.94%) or with family insurance (8.73%). When stratified across wealth index quartiles, such events were similar across insurance categories, with more such events among the lowest quintile compared to highest quintiles of wealth index. Median out-of-pocket expenditure per hospitalization was ₹2000 (interquartile range [IQR] ₹1000 to ₹4000; US$33.33 [IQR16.67–66.67]). The median expenditure was similar across insurance subtypes and wealth index quintiles [Figure - 1] and [Figure - 2].

|

| Figure 2: Catastrophic health expenditure by wealth quintile and insurance status CBHI community-based health insurance |

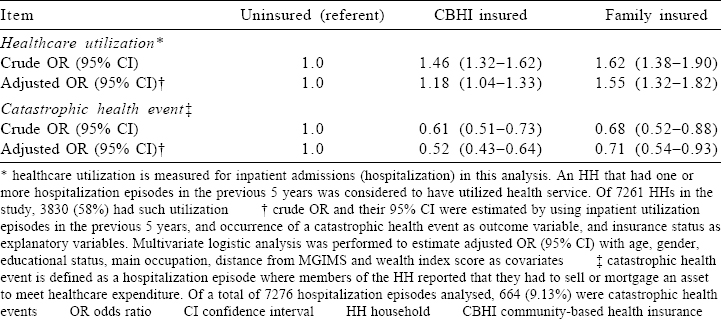

If an HH is participating in a CBHI scheme, it significantly increases odds of utilization of inpatient services (OR 1.18; 95% CI 1.04–1.33), and protects from catastrophic health events (OR 0.52; 95% CI 0.43–0.64), even after adjusting for confounders such as age, gender, years of education, members in an HH, distance from hospital and wealth index. HHs that participate in a family insurance scheme have higher odds of utilization and lower protection from catastrophic health events [Table - 3].

Discussion

We found that CBHI HHs have a significantly higher healthcare utilization, and are protected against catastrophic health expenditure due to hospitalization, an effect that remains significant even after adjusting for socioeconomic status and other confounders. However, membership to a CBHI scheme is influenced by socioeconomic status, as a proportion of HHs in the lowest quintile of wealth index is higher among uninsured compared to insured. While overall healthcare utilization is significantly higher among insured, there is a wealth index driven gradient in each insurance category, and poor among insured have lower utilization compared to those who are more affluent. As median out-of-pocket expenditure across wealth index quintiles is similar, those in lower quintiles had a higher proportion of catastrophic health events where an HH asset was sold or mortgaged.

Those with lowest quintiles of wealth index are more likely to be left out of insurance schemes. Likely reason for this is that the poor choose not to participate, as for them self-reliance becomes a priority only after more basic needs in their HH are met. Many CBHI schemes, despite being pro-poor, with low premiums, and attractive health packages have left out the poorest HHs.[23] While there is a paucity of studies that have evaluated the impact of CBHI schemes from India,[24] Two CBHI schemes from India (self-employed women’s association’s SEWA[25] and Yeshasvini[26]) also had similar results, and reported that poor were either left-out from the insurance cover, or did not benefit from the schemes. SEWA is a low-premium employment-linked scheme, but those not covered are more likely to be poor, and/or unemployed. The Yeshasvini scheme is linked to farmers participating in cooperatives, and likely to exclude landless workers and labourers. However, in both these schemes providers are external to the insurer, which has a potential to limit benefit package, and hence reduced participation. In our study, there were no preconditions in Bachat-Gat and village insurance schemes (included in other CBHI category), The Jawar scheme was special as HHs also had to pledge participation in initiatives for self-reliance. A lower proportion of poor in other CBHI schemes further underscores that economic status remains a powerful predictor of inclusion. During the initial phase in the evolution of the Jawar scheme (before 1994), HHs enjoyed open access without any preconditions for enrolment in the scheme, and the poor preferred to participate. Hence, to improve equity, economically dis-advantaged HHs, especially those led by women, need to be targeted for enrolment, and offered open access to free medical care for any unpredictable illness. A CBHI study from Burkina Faso has shown that targeted subsidies improve enrolment among the poor.[27] This is also a rationale for large state-run insurance schemes where governments take responsibility to pay health premiums for poor, either completely or partially, for limited or extended periods of time. Efficient use of such subsidies undoubtedly depends on what definitions of poverty are used, and identification of HHs for such a benefit.

In our study, even if poor HHs were enrolled in a CBHI scheme, their utilization of healthcare services was lower compared to the rich. Income remains an important determinant for utilization and subsequent benefit from a scheme.[28],[29] This is particularly seen in reimbursement type CBHI schemes, as was seen in a cluster-randomized trial by Ranson et al., where utilization in poor continued to be low, despite improving administrative mechanisms.[25] This is understandable as insurance schemes usually only cover hospital costs, while other expenditure associated with being hospitalized (transportation, loss of wages and lodging for caregivers) can be daunting and a barrier to accessing healthcare. Outpatient services that require much less out-of-pocket payments are much less affected, as shown in our study. This implies that conversion from an outpatient to inpatient care in times of need occurs less frequently among the uninsured, who are more likely to forgo healthcare utilization to avoid these costs. Among the poor, utilization of in-hospital services was highest in the Jawar scheme (0.81 v. 0.62 hospitalizations per HH among the uninsured). This is likely because this scheme assures free hospitalization for any unpredictable illnesses.

Healthcare utilization among the insured in our study was significantly high, even after adjusting for poverty, distance and other demographic confounders. While this is mostly due to improved access to healthcare, adverse selection of HHs in insurance schemes cannot be excluded. In our study, inpatient utilization was 18% higher in CBHI and 55% higher in family insurance HHs. Enrolment in CBHI is a community-wide decision, which is less likely to be influenced by pre-existing disease conditions. Enrolment in family insurance and its annual renewal is more likely to be influenced by the presence of pre-existing disease conditions. We hypothesize that the difference of inpatient utilization of about 37% represents the magnitude of adverse-selection in family insurance schemes. The increment in CBHI utilization is likely to be mostly due to improved access to healthcare. CBHI schemes have also shown to increase the demand for services and can be an initial trigger to promote the use of healthcare facilities.[30]

Previous studies have reported that lack of use of health services in a previous year, lower economic status, affordability and poor perceived quality of services are some of the factors which predict drop-out from insurance schemes,[31] factors that also affect CBHI schemes.[32] While our study was not designed to understand predictors of drop-out from insurance schemes, but some of the same factors as above are likely in our setting as well. Some studies suggest that the overall cost of treatment is reduced in insured, as they are more likely to reach health-facilities early, with less serious health issues. We did not find such a difference as median out-of-pocket expenditure was similar across insurance categories. This could also be due to the benefit package, as various non-hospital healthcare costs, particularly drugs are not covered under schemes managed by MGIMS. Previous studies suggest that the highest out-of-pocket expenditure is due to medicine use (median 41%) of total health expenditure.[23]

CBHI schemes aim to protect families against catastrophic health expenditures. In a recent evaluation from Nepal, the most catastrophic expenditures occurred due to injury-related illnesses, followed by chronic medical conditions.[33] We found a strong protective effect against catastrophic health events in our study, and CBHI schemes can reduce need to sell or mortgage an HH asset by half. However, this benefit needs to be evaluated in light of lower healthcare utilization among uninsured, and poor insured HHs. The proportion of HHs with catastrophic health events was higher in the second and third quintiles (middle class) compared to the first or fifth quintiles (poor or rich). This explains that point estimate of protective effect (odds ratio) moved away from null when we adjusted for socioeconomic status. Thus, protection against catastrophic events is more likely among the middle-class HHs, who are also more likely to agree for expensive treatments. Since catastrophic health events result in loss of assets (and hence lead to poverty), enrolment in CBHI schemes improve economic status of an HH. This has been shown in a before and after analysis of a CBHI scheme in Africa, where enrolment not only protected HH assets but also increased HH assets over time.[34] There is strong external evidence that CBHI provides some financial protection by reducing out-of-pocket spending.[13] Since catastrophic events were <10% of all hospitalization episodes over previous 5 years, hence in absolute terms size of this protective effect is likely to be small. It, however, remains debatable if these benefits lead to improved health. In addition to society-level economics, improvement in health is also dependent on complex macroeconomic, infrastructure and facility level enhancements. A recent study reported no difference in mortality among members and non-members of a CBHI scheme.[35] A major limitation of this approach is that intermediate-term indicators of health may be more informative, compared to mortality which is influenced only after a long period.

Our study has several strengths––it is large in size, and evaluates CBHI schemes that have been operational for about one to three decades. This study also has important limitations. First, it is from a restricted geographical area and does not include any urban HHs which are more likely to have higher health expenditures; second, most healthcare needs were met at MGIMS hospital, which is a teaching medical institute that provides subsidised rational healthcare. Thus, results may not be generalizable to settings with tertiary care treatments that have a higher cost, and more catastrophic health events; lastly, CBHI models that are followed at MGIMS have very low premiums and modest benefit package. All these factors are likely to underestimate the effect of improved utilization or protection from catastrophic health expenditures.

Socioeconomic status is an important determinant both for enrolment as well as subsequent utilization of health services.[36] Hence, whether CBHI schemes will themselves achieve UHC is controversial. While there is some evidence that trust in the scheme, and packages offered by cooperatives that have a greater community involvement have higher healthcare utilization.[37] It is also important that governments step in to regulate and subsidise CBHI schemes,[38] so that they must also run well and should have strong linkages with participating healthcare benefits. In this context, it is important to understand RSBY, a health insurance scheme operated by the Government of India for poor families, which was launched in early 2008. While initial targets were only the below poverty line (BPL) HHs but was subsequently expanded to cover other defined categories of unorganized workers as well.[39] Karan et al.[40] performed impact evaluation at the national level by using National Sample Survey Organization’s cross-sectional survey data on HH expenditures from 3 waves (1999–2000, 2004–05 and 2011–12) of which 2 were conducted before the launch of RSBY and one after 3 years from launch. They found increase in likelihood of reporting any outpatient out-of-pocket expenditure coupled with marginal reduction in the level of this expenditure. However, RSBY did not provide protection from catastrophic health expenditure (based on HH expenditure rather than loss of asset) neither had an impact on inpatient out-of-pocket expenditure. RSBY had weak linkages with participating hospitals, and this could be a reason for not finding a definite benefit.

We found that CBHI schemes improve healthcare utilization, prevent catastrophic health events, but enrolment of the poor is low. Hence, CBHI schemes should be encouraged for their benefits, but there is a need to proactively develop mechanisms for the inclusion of poor in such schemes. This will ensure that benefits are utilized by those who need them the most. These mechanisms include making medical care freely available for the poor and further subsidising indirect costs towards healthcare.

Acknowledgement

We would like to thank all the social workers and village health workers who helped us in data collection and data entry.

Conflicts of interest. None declared

| 1. | Devadasan N, Seshadri T, Trivedi M, Criel B. Promoting universal financial protection: Evidence from the Rashtriya Swasthya Bima Yojana (RSBY) in Gujarat, India. Health Res Policy Syst 2013;11:29. [Google Scholar] |

| 2. | Thakur J. Key recommendations of high-level expert group report on universal health coverage for India. Indian J Community Med 2011;36:S84–5. [Google Scholar] |

| 3. | Singh Z. Universal health coverage for India by 2022: A utopia or reality? Indian J Community Med 2013;38:70–3. [Google Scholar] |

| 4. | Vargas JR, Muiser J. Promoting universal financial protection: A policy analysis of universal health coverage in Costa Rica (1940-2000). Health Res Policy Syst 2013;11:28. [Google Scholar] |

| 5. | Reddy KS. Universal health coverage in India: The time has come. Natl Med J India 2012;25:65–7. [Google Scholar] |

| 6. | Ranson MK. Community-based health insurance schemes in India: A review. Natl Med J India 2003;16:79–89. [Google Scholar] |

| 7. | Donfouet HP, Mahieu PA. Community-based health insurance and social capital: A review. Health Econ Rev 2012;2:5. [Google Scholar] |

| 8. | Dror DM, Vellakkal S. Is RSBY India’s platform to implementing universal hospital insurance? Indian J Med Res 2012;135:56–63. [Google Scholar] |

| 9. | Ranson MK, Sinha T, Chatterjee M, Acharya A, Bhavsar A, Morris SS, et al. Making health insurance work for the poor: Learning from the self-employed women’s association’s (SEWA) community-based health insurance scheme in India. Soc Sci Med 2006;62:707–20. [Google Scholar] |

| 10. | Sinha T, Ranson MK, Chatterjee M, Mills A. Management initiatives in a community- based health insurance scheme. Int J Health Plann Manage 2007;22:289–300. [Google Scholar] |

| 11. | Zhang L, Wang H, Wang L, Hsiao W. Social capital and farmer’s willingness-to- join a newly established community-based health insurance in rural China. Health Policy 2006;76:233–42. [Google Scholar] |

| 12. | Ozawa S, Walker DG. Trust in the context of community-based health insurance schemes in Cambodia: Villagers’ trust in health insurers. Adv Health Econ Health Serv Res 2009;21:107–32. [Google Scholar] |

| 13. | Ekman B. Community-based health insurance in low-income countries: A systematic review of the evidence. Health Policy Plan 2004;19:249–70. [Google Scholar] |

| 14. | Desai S, Mahal A, Sinha T, Schellenberg J, Cousens S. The effect of community health worker-led education on women’s health and treatment-seeking: A cluster randomised trial and nested process evaluation in Gujarat, India. J Glob Health 2017;7:020404. [Google Scholar] |

| 15. | Liu K, Cook B, Lu C. Health inequality and community-based health insurance: A case study of rural Rwanda with repeated cross-sectional data. Int J Public Health 2019;64:7-14. [Google Scholar] |

| 16. | Gebru T, Lentiro K. The impact of community-based health insurance on health- related quality of life and associated factors in Ethiopia: A comparative cross- sectional study. Health Qual Life Outcomes 2018;16:110. [Google Scholar] |

| 17. | Dror DM, Chakraborty A, Majumdar A, Panda P, Koren R. Impact of community- based health insurance in rural India on self-medication & financial protection of the insured. Indian J Med Res 2016;143:809–20. [Google Scholar] |

| 18. | Raza WA, van de Poel E, Bedi A, Rutten F. Impact of community-based health insurance on access and financial protection: Evidence from three randomized control trials in rural India. Health Econ 2016;25:675–87. [Google Scholar] |

| 19. | Raza WA, Van de Poel E, Panda P, Dror D, Bedi A. Healthcare seeking behaviour among self-help group households in rural Bihar and Uttar Pradesh, India. BMC Health Serv Res 2016;16:1. [Google Scholar] |

| 20. | Jajoo UN, Bhan A. Jowar rural health insurance scheme. Econ Polit Wkly 2004;38:3184. [Google Scholar] |

| 21. | Robyn PJ, Sauerborn R, Bärnighausen T. Provider payment in community-based health insurance schemes in developing countries: A systematic review. Health Policy Plan 2013;28:111–22. [Google Scholar] |

| 22. | Filmer D, Pritchett LH. Estimating wealth effects without expenditure data––Or tears: An application to educational enrollments in states of India. Demography 2001;38:115–32. [Google Scholar] |

| 23. | Vialle-Valentin CE, Ross-Degnan D, Ntaganira J, Wagner AK. Medicines coverage and community-based health insurance in low-income countries. Health Res Policy Syst 2008;6:11. [Google Scholar] |

| 24. | Bhageerathy R, Nair S, Bhaskaran U. A systematic review of community-based health insurance programs in South Asia. Int J Health Plann Manage 2017;32:e218–31. [Google Scholar] |

| 25. | Ranson MK, Sinha T, Chatterjee M, Gandhi F, Jayswal R, Patel F, et al. Equitable utilisation of Indian community based health insurance scheme among its rural membership: Cluster randomised controlled trial. BMJ 2007;334:1309. [Google Scholar] |

| 26. | Aggarwal A. Impact evaluation of India’s ‘yeshasvini’ community-based health insurance programme. Health Econ 2010;19 Suppl:5–35. [Google Scholar] |

| 27. | Souares A, Savadogo G, Dong H, Parmar D, Sié A, Sauerborn R, et al. Using community wealth ranking to identify the poor for subsidies: A case study of community-based health insurance in Nouna, Burkina Faso. Health Soc Care Community 2010;18:363–8. [Google Scholar] |

| 28. | Wang H, Yip W, Zhang L, Wang L, Hsiao W. Community-based health insurance in poor rural China: The distribution of net benefits. Health Policy Plan 2005;20:366–74. [Google Scholar] |

| 29. | Gnawali DP, Pokhrel S, Sié A, Sanon M, De Allegri M, Souares A, et al. The effect of community-based health insurance on the utilization of modern health care services: Evidence from Burkina Faso. Health Policy 2009;90:214–22. [Google Scholar] |

| 30. | Smith KV, Sulzbach S. Community-based health insurance and access to maternal health services: Evidence from three West African countries. Soc Sci Med 2008;66:2460–73. [Google Scholar] |

| 31. | Dong H, De Allegri M, Gnawali D, Souares A, Sauerborn R. Drop-out analysis of community-based health insurance membership at Nouna, Burkina Faso. Health Policy 2009;92:174–9. [Google Scholar] |

| 32. | Parmar D, Souares A, de Allegri M, Savadogo G, Sauerborn R. Adverse selection in a community-based health insurance scheme in rural Africa: Implications for introducing targeted subsidies. BMC Health Serv Res 2012;12:181. [Google Scholar] |

| 33. | Swe KT, Rahman MM, Rahman MS, Saito E, Abe SK, Gilmour S, et al. Cost and economic burden of illness over 15 years in Nepal: A comparative analysis. PLoS One 2018;13:e0194564. [Google Scholar] |

| 34. | Parmar D, Reinhold S, Souares A, Savadogo G, Sauerborn R. Does community- based health insurance protect household assets? Evidence from rural Africa. Health Serv Res 2012;47:819–39. [Google Scholar] |

| 35. | Hounton S, Byass P, Kouyate B. Assessing effectiveness of a community-based health insurance in rural Burkina Faso. BMC Health Serv Res 2012;12:363. [Google Scholar] |

| 36. | Umeh CA, Feeley FG. Inequitable access to health care by the poor in community- based health insurance programs: A review of studies from low- and middle- income countries. Glob Health Sci Pract 2017;5:299–314. [Google Scholar] |

| 37. | Ranabhat CL, Kim CB, Singh DR, Park MB. A comparative study on outcome of government and co-operative community-based health insurance in Nepal. Front Public Health 2017;5:250. [Google Scholar] |

| 38. | Adomah-Afari A, Chandler JA. The role of government and community in the scaling up and sustainability of mutual health organisations: An exploratory study in Ghana. Soc Sci Med 2018;207:25–37. [Google Scholar] |

| 39. | RSBY. Available at www.rsby.gov.in/about_rsby.aspx (accessed on 9 Aug 2018). [Google Scholar] |

| 40. | Karan A, Yip W, Mahal A. Extending health insurance to the poor in India: An impact evaluation of Rashtriya Swasthya Bima Yojana on out of pocket spending for healthcare. Soc Sci Med 2017;181:83–92. [Google Scholar] |

Fulltext Views

2,169

PDF downloads

403